Understanding How To link Three Financial Statement In Detail + Excel Template

- Jun 15, 2024

- 5 min read

Updated: Aug 18, 2024

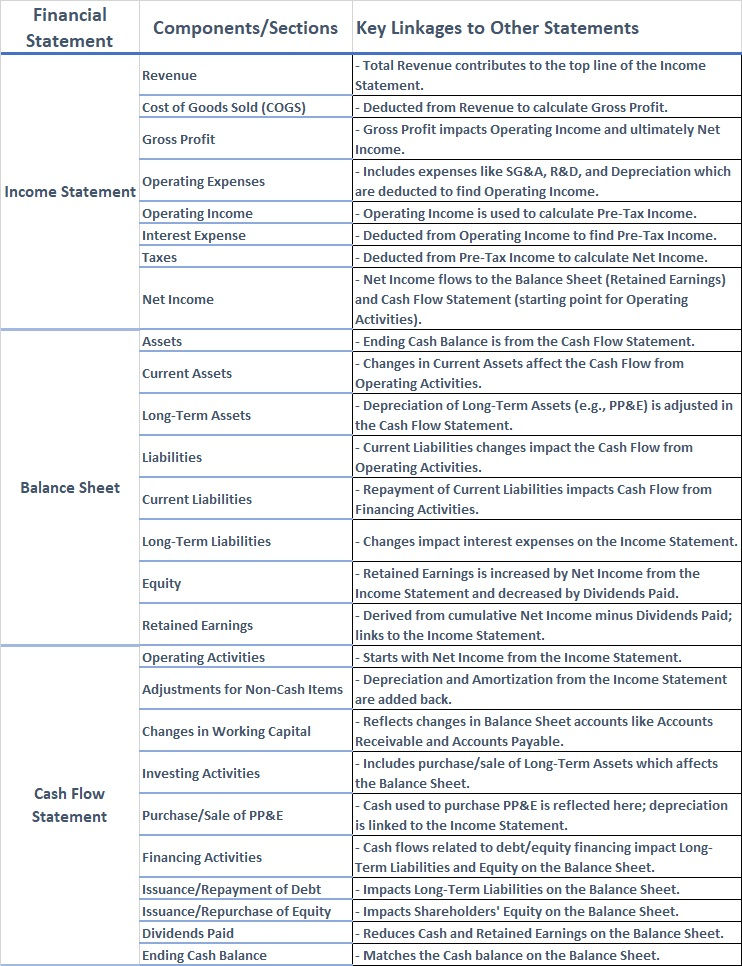

Understanding how the Three Financial Statements link together

While it is critical to understand the income statement, balance sheet, and cash flow statement on their own, it is also critical to understand how the three financial statements work in conjunction with one another.

Financial modelling takes up a significant amount of time for analysts working in investment banking, corporate mergers and acquisitions, and private equity. Business and asset performance can be predicted using financial models, which are simplified representations of the underlying data. They can assist in determining, among other things, how a business is expected to develop in the future, what a fair price for the enterprise or asset would be, and what capital requirements the company may encounter.

Having said that, a financial model must include financial statements that are properly linked to one another as well as a balancing balance sheet. Furthermore, financial analysts must be familiar with the concept of circularity in a financial model.

The section below will provide you with an easy-to-understand overview of the relationship between the three financial statements.

How are the Three Financial Statements Linked?

Step-by-Step Linkage with Detailed Examples

1. Income Statement

Components:

Revenue: Total income from sales or services. For example, a company sells $1,000,000 worth of goods.

Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold. If COGS is $600,000, then:

Gross Profit: Revenue - COGS = $1,000,000 - $600,000 = $400,000

Operating Expenses: Indirect costs like salaries, rent, and utilities. For example:

Salaries: $80,000

Rent: $40,000

Utilities: $10,000

Depreciation: $70,000

Total Operating Expenses = $200,000

Operating Income: Gross Profit - Operating Expenses = $400,000 - $200,000 = $200,000

Interest Expense: Cost of debt. For example, interest on loans is $20,000.

Pre-Tax Income: Operating Income - Interest Expense = $200,000 - $20,000 = $180,000

Taxes: Taxes on income. If the tax rate is 30%, then taxes are $54,000.

Net Income: Pre-Tax Income - Taxes = $180,000 - $54,000 = $126,000

Linkages:

Net Income is added to the Retained Earnings in the Balance Sheet.

Net Income is the starting point for the Cash Flow from Operating Activities in the Cash Flow Statement.

2. Balance Sheet

Components:

Assets: Resources owned by the company.

Current Assets: Cash, Accounts Receivable, Inventory, etc.

Example: Cash: $50,000, Accounts Receivable: $80,000, Inventory: $70,000

Long-Term Assets: Property, Plant & Equipment (PP&E), say $500,000.

Example Changes:

Accounts Receivable increases by $20,000 (from $80,000 to $100,000).

Inventory increases by $10,000 (from $70,000 to $80,000).

Depreciation on PP&E is $70,000.

Liabilities and Equity:

Liabilities: Obligations of the company.

Current Liabilities: Accounts Payable, Short-term debt, etc.

Example: Accounts Payable: $30,000, Short-term Debt: $20,000

Long-Term Liabilities: Bonds Payable, say $200,000.

Equity:

Common Stock: Investment by shareholders, say $150,000.

Retained Earnings: Accumulated net income, minus dividends.

Example: Previous Retained Earnings: $300,000, Net Income: $126,000, Dividends Paid: $26,000

New Retained Earnings: $300,000 + $126,000 - $26,000 = $400,000

Linkages:

Retained Earnings increase by the Net Income from the Income Statement.

Ending Cash Balance from the Cash Flow Statement appears in Current Assets.

Changes in Current Assets and Liabilities are reflected in the Cash Flow from Operating Activities.

3. Cash Flow Statement

Components:

Operating Activities:

Starts with Net Income: $126,000

Adjustments for Non-Cash Items: Add Depreciation, $70,000.

Changes in Working Capital:

Accounts Receivable: Increase by $20,000, reducing cash flow.

Inventory: Increase by $10,000, reducing cash flow.

Accounts Payable: Increase by $5,000, increasing cash flow.

Calculation:

Cash Flow from Operating Activities: $126,000 (Net Income) + $70,000 (Depreciation) - $20,000 (Accounts Receivable) - $10,000 (Inventory) + $5,000 (Accounts Payable) = $171,000

Investing Activities:

Purchase of PP&E: Cash outflow of $100,000.

Calculation:

Cash Flow from Investing Activities: -$100,000

Financing Activities:

Issuance of Debt: Cash inflow of $50,000.

Repayment of Debt: Cash outflow of $30,000.

Dividends Paid: Cash outflow of $26,000.

Calculation:

Cash Flow from Financing Activities: $50,000 - $30,000 - $26,000 = -$6,000

Ending Cash Balance:

Starting Cash: Assume $50,000.

Net Change in Cash: $171,000 (Operating) - $100,000 (Investing) - $6,000 (Financing) = $65,000.

Ending Cash Balance: $50,000 + $65,000 = $115,000.

Linkages:

Operating Activities start with Net Income from the Income Statement.

Non-Cash Items like Depreciation from the Income Statement are added back.

Changes in Working Capital reflect changes in Balance Sheet accounts.

Ending Cash Balance appears on the Balance Sheet under Current Assets.

Summary of Detailed Interconnections

Income Statement to Balance Sheet:

Net Income increases Retained Earnings in the Balance Sheet.

Balance Sheet to Cash Flow Statement:

Changes in Current Assets and Liabilities in the Balance Sheet impact the Cash Flow from Operating Activities.

Purchase of Long-Term Assets impacts the Cash Flow from Investing Activities.

Issuance and Repayment of Debt, and Dividends Paid, impact the Cash Flow from Financing Activities.

Cash Flow Statement to Balance Sheet:

Ending Cash Balance in the Cash Flow Statement is reflected in the Balance Sheet.

Example Summary:

Income Statement:

Revenue: $1,000,000

Net Income: $126,000

Balance Sheet:

Retained Earnings increase by Net Income ($126,000).

Retained Earnings: $300,000 + $126,000 - $26,000 = $400,000.

Cash Balance changes according to the Cash Flow Statement.

Cash Flow Statement:

Starting with Net Income: $126,000.

Adjustments: Add Depreciation ($70,000).

Changes in Working Capital: Accounts Receivable (-$20,000), Inventory (-$10,000), Accounts Payable (+$5,000).

Net Cash from Operating Activities: $171,000.

Investing Activities: Purchase of PP&E (-$100,000).

Financing Activities: Issuance of Debt (+$50,000), Repayment of Debt (-$30,000), Dividends Paid (-$26,000).

Net Change in Cash: $65,000.

Ending Cash Balance: $115,000.

Excel Template

Frequently Asked Questions (FAQ)

What is the purpose of linking the financial statements?

Linking the financial statements allows for a comprehensive analysis of a company's financial performance and position. It helps stakeholders understand how net income flows into the balance sheet and how it is adjusted in the cash flow statement, providing insights into profitability, liquidity, and solvency.

How does net income from the income statement affect the balance sheet?

Net income increases the retained earnings section of the balance sheet. Retained earnings represent the accumulated profits that have not been distributed to shareholders as dividends, contributing to shareholders' equity.

How is net income adjusted in the cash flow statement?

Net income from the income statement serves as a starting point for the operating activities section of the cash flow statement. Adjustments are made to reflect the actual cash flows, such as adding back non-cash expenses (e.g., depreciation, amortization) and incorporating changes in working capital items (e.g., accounts receivable, accounts payable).

Why is the cash flow statement important?

The cash flow statement provides insights into a company's cash generation and utilization. It highlights the sources and uses of cash from operating, investing, and financing activities, helping evaluate a company's ability to generate cash, its investment decisions, and its financing activities.

How do the financial statements work together for financial analysis?

Financial analysis involves examining the relationships between the financial statements. The income statement shows the company's revenues, expenses, and net income. The balance sheet presents the financial position, including assets, liabilities, and shareholders' equity. The cash flow statement complements the other statements by providing information on cash flows. By analyzing these statements collectively, one can assess the company's profitability, liquidity, and overall financial health.

Are there any limitations to the financial statements' linkages?

While the linkages between the financial statements provide valuable insights, they have certain limitations. The statements are based on accounting principles and estimates, which may affect their accuracy. Additionally, non-cash items, timing differences, and other factors can impact the relationships between the statements. Therefore, it's important to consider additional factors and perform a thorough analysis when interpreting the financial statements.

Are there any other financial statements apart from the three mentioned?

The income statement, balance sheet, and cash flow statement are the primary financial statements. However, some companies may also prepare a statement of changes in shareholders' equity, which provides details on the changes in shareholders' equity over a period.

-min.png)

-min.png)

Comments