Net Operating Profit After Tax (NOPAT) Margin

- Sep 9, 2024

- 11 min read

Understanding Net Operating Profit After Tax (NOPAT) Margin

In the world of finance, accurate evaluation of a company's profitability and operational efficiency is key to decision-making. One critical metric that often comes into play is Net Operating Profit After Tax (NOPAT) Margin. This figure provides investors, managers, and financial analysts with a comprehensive view of how much profit a company generates from its core operations after accounting for taxes, but before considering debt and capital structure. Let's delve deeper into understanding how this metric works and why it's so important.

What is Net Operating Profit After Tax (NOPAT)?

To begin, Net Operating Profit After Tax (NOPAT) refers to a company’s profits derived from its core business operations after accounting for taxes, but excluding interest expenses and other financial costs. NOPAT gives a clear picture of operational efficiency, helping analysts understand how well the company is performing before considering its financing decisions (like issuing debt or equity). In simple terms, it shows how much the company would make if it had no debt.

The formula for NOPAT is

Here, operating income (also known as EBIT or earnings before interest and taxes) reflects the company's core profitability, while the tax rate accounts for the tax obligations on those earnings.

Breaking Down the NOPAT Margin

NOPAT Margin takes this concept one step further by expressing NOPAT as a percentage of revenue. It essentially shows how much of every dollar of revenue turns into profit after tax, but before financing costs are deducted. This is useful for comparing companies with different levels of debt and assessing how efficiently they convert revenue into profits from their operations.

The formula for NOPAT Margin is:

By examining NOPAT Margin, stakeholders gain insights into the company’s ability to manage its operational costs and taxes, thereby giving a true reflection of its core business profitability.

Why is NOPAT Margin Important?

1. Provides a Clearer View of Operational Efficiency

NOPAT Margin strips out the effects of capital structure, allowing for a purer measure of how efficiently a company is operating. This is especially valuable when comparing companies in the same industry, as debt levels can vary widely, distorting profitability comparisons if you're only looking at net income.

2. Useful for Evaluating Performance Over Time

NOPAT Margin enables financial analysts and managers to track the company’s operational performance over time. By excluding financing effects, it allows for a consistent comparison of how efficiently the company is running its business regardless of changes in its capital structure.

3. Helps in Comparative Analysis

Because NOPAT excludes financing costs and focuses solely on operational income, it allows for better comparison across companies with different capital structures. For example, a highly leveraged company may have lower net income due to high interest expenses, but if its NOPAT margin is strong, it shows that its core operations are highly profitable.

How to Calculate NOPAT Margin: A Step-by-Step Guide

To calculate the NOPAT margin, follow these simple steps:

Determine the Operating Income (EBIT)Start by identifying the company’s operating income. This is the profit the company makes from its core business activities before considering interest and taxes.

Apply the Tax RateNext, apply the company’s effective tax rate to the operating income to determine the NOPAT.

Calculate the NOPAT MarginFinally, divide the NOPAT by the company’s total revenue to calculate the NOPAT margin.

Real-World Example of NOPAT Margin Calculation

To analyze the NOPAT (Net Operating Profit After Tax) margins of different companies across various sectors, we will calculate and interpret the NOPAT margins for five real companies. Each example will include a financial statement overview, the calculation formula, a detailed breakdown, and logical interpretations.

1. Company: Apple Inc. (Technology Sector)

Financial Overview

Revenue: $394.3 billion

Operating Income: $119.4 billion

Tax Rate: 15%

Calculation

Interpretation

Apple's NOPAT margin of 25.7% indicates strong profitability from its core operations, reflecting effective cost management and a robust market position.

2. Company: JPMorgan Chase (Financial Sector)

Financial Overview

Revenue: $132.3 billion

Operating Income: $48.5 billion

Tax Rate: 21%

Calculation

Interpretation

JPMorgan Chase's NOPAT margin of 28.9% demonstrates its efficiency in generating profits from its banking operations, highlighting its competitive advantage in the financial sector.

3. Company: Procter & Gamble (Consumer Goods Sector)

Financial Overview

Revenue: $80.2 billion

Operating Income: $16.5 billion

Tax Rate: 22%

Calculation

Interpretation

Procter & Gamble's NOPAT margin of 16.0% reflects solid operational efficiency, though lower than tech and financial sectors, indicating the competitive nature of consumer goods.

4. Company: ExxonMobil (Energy Sector)

Financial Overview

Revenue: $413.2 billion

Operating Income: $55.7 billion

Tax Rate: 25%

Calculation

Interpretation

ExxonMobil's NOPAT margin of 10.1% is lower than the other sectors analyzed, reflecting the volatility and high operational costs typical in the energy industry.

5. Company: Tesla Inc. (Automotive Sector)

Financial Overview

Revenue: $81.5 billion

Operating Income: $13.6 billion

Tax Rate: 18%

Calculation

Interpretation

Tesla's NOPAT margin of 13.7% indicates a growing efficiency in its operations, but it remains challenged compared to more established companies in other sectors.

Factors That Affect NOPAT Margin

Several factors can influence a company’s NOPAT margin, some of which include:

1. Tax Rates

Changes in corporate tax rates can significantly affect NOPAT margin, as taxes are a direct deduction from operating income. Companies operating in jurisdictions with higher tax rates will generally have lower NOPAT margins.

2. Operating Efficiency

How well a company manages its operating expenses has a direct impact on its NOPAT margin. Efficient cost control and productivity improvements can boost the margin by increasing operating income relative to revenue.

3. Revenue GrowthIncreasing revenue without a corresponding rise in costs typically leads to higher operating income and, consequently, a higher NOPAT margin. On the other hand, if revenue growth is accompanied by a proportional rise in costs, the margin may remain flat or even decline.

4. Industry FactorsDifferent industries have varying levels of profitability due to factors like competition, cost structures, and pricing power. As such, it’s important to compare NOPAT margins within the same industry to get a meaningful comparison.

Improving NOPAT Margin: Strategies for Businesses

For companies looking to improve their NOPAT margin, there are several key strategies to consider:

1. Focus on Operational Efficiency

Cutting unnecessary costs and improving efficiency can significantly boost operating income, and thus the NOPAT margin. This might involve streamlining production processes, renegotiating supplier contracts, or adopting new technologies to automate tasks.

2. Tax Planning

Optimizing tax strategies can also play a crucial role in improving NOPAT margin. Companies may look for tax credits, deductions, or strategies to defer taxes to reduce their overall tax burden.

3. Revenue Growth Without Proportionate Cost Increase

Businesses should aim for scalable growth, where revenue increases at a faster rate than operating costs. This can be achieved through price increases, entering new markets, or offering higher-margin products or services.

4. Effective Management of Fixed Costs

Keeping fixed costs in check as revenue grows is another way to improve the NOPAT margin. Businesses that can expand their output without a significant rise in fixed costs will see their margins improve over time.

Common Pitfalls in Interpreting NOPAT Margin

While NOPAT margin is a valuable metric, there are a few common mistakes that analysts and managers should avoid when interpreting the results:

1. Ignoring Capital Structure

Although NOPAT margin excludes the effects of debt, it’s important not to ignore the company’s overall capital structure. A company with high NOPAT margins but unsustainable debt levels may face financial distress in the future.

2. Comparing Across Industries

Since different industries have different cost structures and profit margins, comparing NOPAT margins across industries may lead to incorrect conclusions. It’s best to compare companies within the same industry.

3. Neglecting Non-Operating Income

NOPAT margin focuses solely on operating income and excludes non-operating items like investment income or one-time gains. While this provides a clear picture of operational efficiency, it can overlook important factors that contribute to overall profitability.

NOPAT Margin vs. Other Profitability Ratios

When analyzing a company’s financial health and performance, various ratios help provide insights into different aspects of its profitability, operational efficiency, and overall financial performance. Among these, Net Operating Profit After Tax (NOPAT) Margin holds a significant place. However, it’s essential to understand how it compares to other widely used profitability ratios like net profit margin, operating margin, and return on equity (ROE). Each of these ratios measures different facets of a company’s financial efficiency, and understanding their unique purposes can give investors and financial analysts a well-rounded view.

Let’s dive deeper into a comparative analysis of NOPAT Margin vs. Other Ratios to better understand their distinct roles.

NOPAT Margin vs. Net Profit Margin

Net Profit Margin is perhaps the most common profitability metric, giving a broad overview of how much net income a company generates for each dollar of revenue. It includes all operating and non-operating activities like interest expenses, taxes, and non-recurring items such as one-time gains or losses.

Formula for Net Profit Margin:

Key Differences:

Inclusion of Financing and Non-Operating Items: While NOPAT margin focuses on operational performance by excluding interest and non-operating income, net profit margin incorporates these factors, giving a comprehensive view of the company’s bottom-line profitability.

Tax and Debt Considerations: Net profit margin is affected by a company’s debt structure and tax optimization strategies, whereas NOPAT margin gives a purer look at operational efficiency by excluding the effects of financing decisions.

Operational Focus: NOPAT margin is specifically useful for comparing companies across industries or regions with different tax rates or capital structures, while net profit margin is more suited for understanding the overall profitability, including the impact of debt, taxes, and other financial activities.

In essence, NOPAT Margin is better for analyzing core operational efficiency, while Net Profit Margin provides a more holistic view of total profitability.

NOPAT Margin vs. Operating Margin

Operating Margin measures the percentage of revenue that remains after covering operating expenses but before accounting for taxes and interest. It is similar to NOPAT margin in that both focus on operational efficiency, but operating margin stops short of factoring in taxes.

Formula for Operating Margin:

Key Differences:

Tax Impact: The primary difference between operating margin and NOPAT margin lies in the treatment of taxes. Operating margin does not account for taxes, while NOPAT margin does, offering a more realistic look at post-tax profitability from operations.

Use in Comparison: Since operating margin excludes taxes, it may provide a more favorable view of a company’s profitability in high-tax environments. NOPAT margin, however, is more reflective of the actual post-tax operating performance, making it better for comparing companies across regions with varying tax rates.

Clarity of Operational Profitability: Both ratios are ideal for assessing the company’s ability to generate profits from its core operations, but NOPAT margin provides a more accurate post-tax view, while Operating Margin is tax-neutral.

Operating margin and NOPAT margin are closely aligned, but for businesses operating in tax-sensitive environments, NOPAT margin offers a clearer picture of after-tax efficiency.

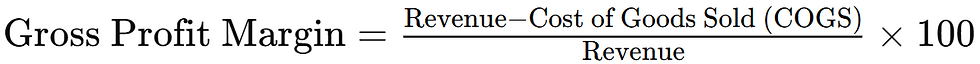

NOPAT Margin vs. Gross Profit Margin

Gross Profit Margin focuses solely on the company’s production efficiency by measuring the percentage of revenue remaining after accounting for the cost of goods sold (COGS). It excludes all other operating expenses, taxes, and interest.

Formula for Gross Profit Margin

Key Differences:

Scope of Costs Considered: Gross profit margin only considers direct costs related to production, such as raw materials and labor, while NOPAT margin includes all operating expenses like selling, general, and administrative (SG&A) costs, as well as taxes.

Operational Efficiency Focus: NOPAT margin provides a more comprehensive look at operational efficiency by factoring in both indirect costs and taxes, whereas gross profit margin is focused on the company’s ability to manage direct production costs.

Use Case: Gross profit margin is more relevant for industries where production efficiency is key (e.g., manufacturing or retail), while NOPAT margin is better suited for evaluating overall operational performance, especially after-tax.

While Gross Profit Margin highlights production efficiency, NOPAT Margin offers a more holistic view of overall operational efficiency after taxes.

NOPAT Margin vs. Return on Equity (ROE)

Return on Equity (ROE) is a measure of how efficiently a company uses shareholders’ equity to generate profits. It’s a widely used ratio by investors to assess how well management is using the capital provided by equity investors.

Formula for ROE:

Key Differences:

Focus on Capital Efficiency: While NOPAT margin focuses on operating efficiency, ROE measures the return generated on equity capital. This makes ROE more useful for investors interested in understanding how well their capital is being employed to generate profits.

Debt Considerations: ROE includes the effects of both operating and non-operating activities, including financing decisions. A company with high debt might have an inflated ROE due to leverage, while NOPAT margin isolates operational performance without considering financing.

Comparability: NOPAT margin is better for comparing operational performance across companies with different debt levels, while ROE is useful for evaluating how well management is using equity capital.

While ROE is critical for equity investors looking at overall profitability, NOPAT Margin offers a purer view of operating efficiency without the distortions caused by capital structure decisions.

NOPAT Margin vs. Return on Assets (ROA)

Return on Assets (ROA) is another important profitability ratio that measures how efficiently a company uses its assets to generate net income.

Formula for ROA:

Key Differences:

Asset Utilization: ROA focuses on the efficiency with which a company is utilizing its total asset base to generate profits, while NOPAT margin zeroes in on operational efficiency relative to revenue.

Capital Structure: ROA includes the effects of both equity and debt in the denominator, making it sensitive to a company’s asset base and financing strategy. NOPAT margin is independent of capital structure, focusing solely on the company’s ability to generate post-tax profit from its operations.

Purpose: ROA is ideal for analyzing asset-heavy industries (e.g., manufacturing, real estate), while NOPAT margin is better suited for evaluating operating performance, regardless of the company’s asset base.

ROA is crucial for understanding how well a company is using its assets to create profits, while NOPAT Margin provides insight into operational profitability before considering the company’s assets or capital structure.

NOPAT Margin vs. Earnings Before Interest and Taxes (EBITDA) Margin

EBITDA Margin is a measure of a company’s profitability before accounting for interest, taxes, depreciation, and amortization. It is often used to assess a company’s cash flow generation ability and operating performance.

Formula for EBITDA Margin:

Key Differences:

Exclusion of Depreciation and Amortization: EBITDA margin excludes non-cash expenses like depreciation and amortization, which can sometimes overstate profitability. NOPAT margin, by accounting for taxes and including depreciation, gives a more accurate picture of operational profitability.

Cash Flow Focus: EBITDA is often used as a proxy for cash flow because it excludes non-cash items, whereas NOPAT margin provides a clearer view of profitability by factoring in the costs associated with running the business and paying taxes.

Use Case: EBITDA margin is valuable for companies with significant capital expenditures (CAPEX), while NOPAT margin is useful for evaluating core operational efficiency after tax impacts.

EBITDA margin highlights cash flow generation potential, whereas NOPAT Margin offers a more complete picture of post-tax profitability.

FAQs

What is a good NOPAT margin?

The definition of a "good" NOPAT margin varies by industry. Generally, a higher NOPAT margin indicates greater operational efficiency, but the ideal margin depends on industry norms and the company’s specific business model.

How is NOPAT margin different from net profit margin?

Net profit margin includes all income and expenses, including interest and taxes, while NOPAT margin focuses only on operational income after tax. NOPAT margin excludes financing effects, providing a clearer picture of operational efficiency.

Can a company have a positive NOPAT margin but negative net income?

Yes, a company can have a positive NOPAT margin but negative net income if it has high interest expenses or other non-operating losses. NOPAT margin isolates operational performance, whereas net income includes all financial activities.

Why is NOPAT margin more reliable for comparing companies?

Because it removes the effects of capital structure and focuses solely on operating efficiency, NOPAT margin allows for more accurate comparisons between companies with different debt levels.

How can companies improve their NOPAT margin?Companies can improve their NOPAT margin by cutting costs, improving operational efficiency, growing revenue without proportional cost increases, and optimizing their tax strategies.

Does NOPAT margin account for depreciation?

Yes, NOPAT margin includes depreciation as it is part of operating expenses. This makes it a comprehensive measure of operational efficiency.

Conclusion

Net Operating Profit After Tax (NOPAT) Margin is a critical measure of a company’s operational efficiency and profitability. By stripping away the effects of debt and focusing on core business activities, it provides a clearer picture of how well a company is managing its operations. Understanding and improving NOPAT margin can be a powerful tool for businesses looking to enhance their financial health and deliver better returns to shareholders.

-min.png)

-min.png)

Comments